Recent research from 2024, compiled by LandlordBuyers.com, reveals that private rental prices have risen across the board in England (8.5%), Wales (8.5%), Scotland (7.6%) and Northern Ireland (9.9%) over the past year.

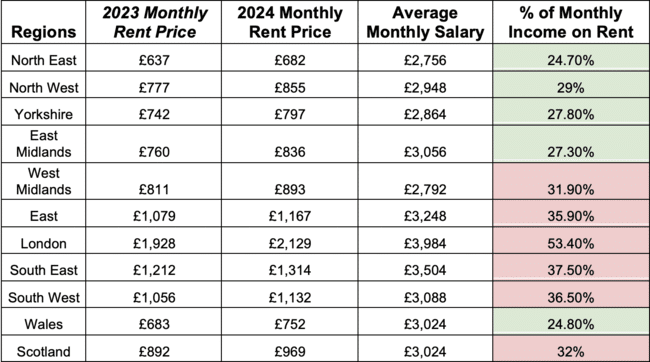

Experts suggest that no more than 30% of a person’s monthly salary should go towards rent. However, in the following regions, tenants are spending well beyond this recommendation:

- London = 53.4% of salary on rent

- South East = 37.5% of salary on rent

- South West = 36.5% of salary on rent

- East England = 35.9% of salary on rent

- Scotland = 32% of salary on rent

- West Midlands = 31.9% of salary on rent

By contrast, other regions in the UK see renters spending less than 30% of their income on rent:

- North East = 24.7% of salary on rent

- Wales = 24.8% of salary on rent

- East Midlands = 27.3% of salary on rent

- Yorkshire = 27.8% of salary on rent

- North West = 29% of salary on rent

Discussing the UK’s current rental market, Jason Harris-Cohen, Managing Director at LandlordBuyers.com, said: “A North-South divide definitely still exists but the divide is tapering. Only in mid-September did estate agent Hamptons release data that showed the gap between rental values in the North and rental values in the South of England has narrowed to its lowest point in over a decade,” explains Jason. “In fact, while it was still more expensive to rent in the South, Southern rents were only 37% more expensive than those in the North – down from 43% more in August 2023 and a peak of 55% more in November 2021.”

Jason points out that the future of the rental price divide will depend on various factors. “One will be landlords themselves: which ones decide to exit the market and where their rentals are geographically located. Buy-to-let professionals are holding their breath ahead of autumn’s Budget. If pockets of landlords, perhaps mainly in the South, decide to sell, we could see supply restricted, values rise and the gap widen again.”

“Conversely,” he continues, “if Labour gets to grips with levelling up, we may see the appeal of Northern towns surge, wages catch up with Southern counterparts and demand for property – both to buy and rent – increase.”

Jason also discusses the role of house prices: “House prices will play their part too. Stagnating property and rental values in the South have been blamed for the rental value slowdown, whereas house price growth in the North has been broadly strong. If this trend continues, we could see Northern values increase further and approach something more like rental equilibrium across the country.”

“In terms of average salaries versus average rental prices, there is still a disparity. While the Office for National Statistics reported wage growth of 5.1% over the three months to July 2024 – outpacing inflation at 2.2% – Goodlord found that the average cost of a new rental home in England was 7% higher in August 2024 compared to the same time in 2023.”