Recent research conducted by LandlordBuyer suggests that in the past year, average salaries in the UK have seen a more significant increase than the average private rental costs.

What Does the Latest Data on Rental Prices and Average Salaries Reveal?

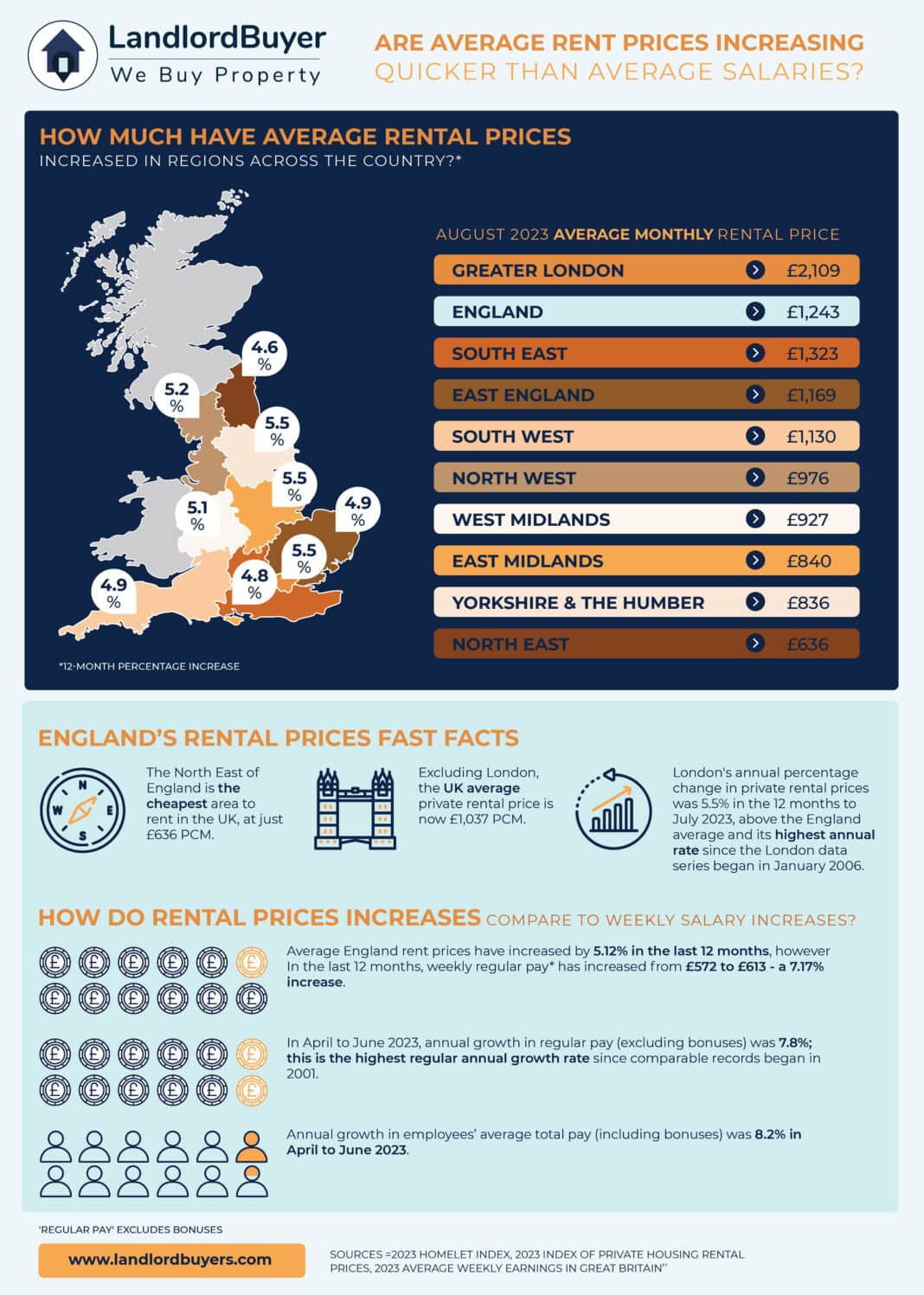

- Over the last 12 months, average rent prices in England have gone up by 5.12%. In contrast, weekly regular pay has increased by 7.17% during the same period, rising from £572 to £613.

- Excluding London, the average private rental price in the UK stands at £1,037 per month.

- London experienced its highest-ever annual rental price percentage increase in the past year, with a 5.5% rise from August 2022 to August 2023.

- In April to June 2023, annual growth in regular pay (excluding bonuses) reached 7.8%. This marks the highest regular annual growth rate since comparable records began in 2001.

Which Regions Offer the Most Affordable Rental Options in the Country?

The North East of England claims the top spot for affordability, with monthly rental prices averaging just £636 per month. Yorkshire and The Humber closely follow with an average rent cost of £836 per month.

What Do Property Experts Predict for the Future of Salaries and Rent Costs in the UK?

Jason Harris-Cohen, Managing Director of LandlordBuyer, offers insights into the evolving relationship between salaries and the cost of renting in the UK:

“The UK’s rental market is subject to a ‘robbing Peter to pay Paul’ scenario. While rising wages mean tenants have more take-home pay, income increases are being spent on rising rents. There really is no current advantage to getting a pay rise, especially if it pushes someone into a higher take bracket – they could actually end up with less money.

There will be a tipping point in the private rental market and I don’t think it’s that far away. Landlords will not be able to keep raising rents indefinitely. Each area and property type will have its ceiling limit. Breach this and the landlord runs the risk of rent arrears, with many tenants already struggling with living costs. Pitch the rent too low and the landlord won’t be able to cover their own expenses.

Landlords exiting the market is making matters worse. The more that leave, the less choice there is and increased competition for rentals will naturally push rents up.

A backdrop to all of this is higher mortgage rates. Despite lenders cutting rates in late summer and early autumn, the reductions are minimal – there’s still a huge gulf between the circa 2% rates we saw three, four years ago and the new normal of 5-6%. This is going to come as a huge shock to landlords coming off fixed-rate buy-to-let mortgages. Realistically, but-to-let may soon become a small pool of mortgage-free properties and cash-buying landlords.

Property investors looking for a silver lining will know that high mortgage rates also keep tenants in rented accommodation. Even with house prices slowly drifting downwards, many first-time buyers simply can’t afford the deposit, stamp duty, mortgage arrangement fee, legal costs and monthly mortgage repayments needed to become a homeowner. Therefore it was no surprise that Zoopla recently declared renting was cheaper than mortgage repayments for the first time in 13 years.”