Wise, the global technology company building the best way to move money around the world, has released new research which has revealed that Manchester-based SMEs spend an estimated third (30%) of their overheads on international payment fees when using traditional banks.

Across the North West, it is estimated that the average business spends £361,571 on international payment fees, whereas the North East came out on top, where they spend an extra 28%.

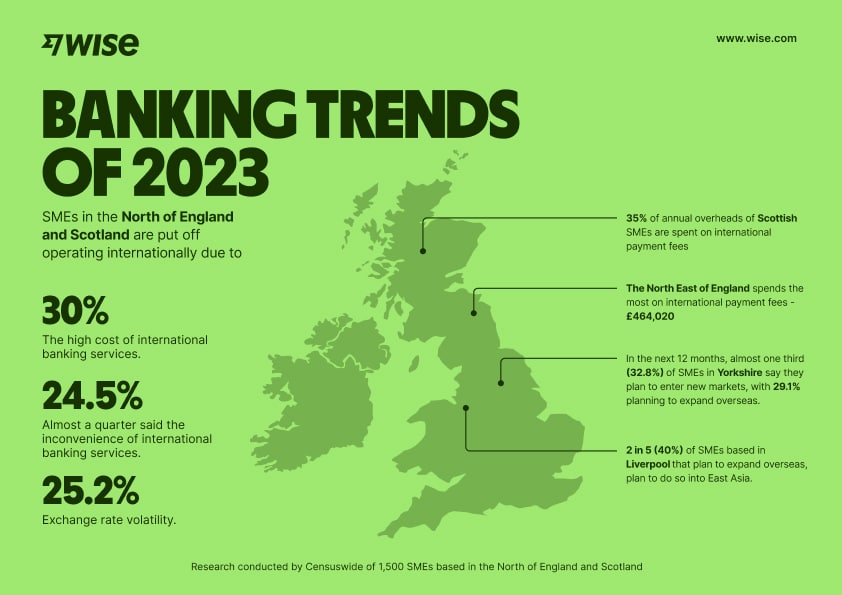

The survey, conducted with 1,500 SMEs across the North of England and Scotland*, showcased the struggles for smaller to medium sized enterprises when it comes to business expansions, given the hands they are dealt around international payment fees as a result of sending and receiving payments via traditional banks.

It is therefore unsurprising to learn that high numbers of Manchester-based SMEs are put off from operating internationally, due to the inconvenience and high cost of international banking services (28%).

Given fraught international conditions when it comes to overseas banking, nearly a third of SMEs across the Manchester (30.2%) claimed that inflation had been one of their biggest challenges and a barrier to success over the last year, closely followed by taxation, and inflation (both 29.1%).

Jack Maddock, Senior Product Manager at Wise, commented: “The data clearly outlines the hugely negative impact that sending and receiving money internationally via traditional banking methods is having on businesses based in Manchester. Whilst banks often profess their support and claim to champion SMEs, it’s clear to see this is a vanity project, and far outside of reality.

“With almost a third of SMEs (31%) surveyed planning to expand overseas within the next 12 months, it’s incredibly concerning to see the extent to which international banking fees are impacting their success and potential for growth. We need to ensure that more is done to support businesses in this situation.

“At Wise, we’re pushing for businesses to be able to transact anywhere seamlessly. That means money without borders: moving it instantly, transparently, conveniently, and eventually for free. Using a digital transfer platform such as Wise allows businesses to manage money globally, built to save money and time, so business owners can spend more time focusing on growing their business.”

Wise is calling on the Government to tighten existing regulations to make fees clearer and the market more competitive so that SMBs have the knowledge they need to make educated financial decisions.

Existing legislation, such as the Cross Border Payment Regulation 2 (CBPR2), states that banks should make fees clear when business customers trade in Euros, however this is often being ignored or circumvented by banks via fees hidden in marked up exchange rates. The situation is even worse for businesses trading overseas outside of the EU, which is particularly alarming given that a third of SMEs in the North of England and Scotland with expansion plans overseas are targeting North America as the priority market. The Payments Services Regulation (PSRs), currently under review, are clear in their aim to achieve greater transparency, but due to vague language and banks having the option of a ‘corporate opt out’ when dealing with business customers, SMBs are the ones to suffer.

Wise is therefore asking the Financial Conduct Authority (FCA) to:

* Better enforce CBPR rules and provide additional guidance to banks

so their intention to ban hidden fees rules is respected

* Ensure that, as part of it PSR review, all payments overseas are

subject to transparency, with banks forced to make fees clear

* End the ‘corporate opt out’, which penalizes SMBs for no good

reason

Simon Fretwell, Founder at RedboxVR, based in the North West, said: “After being recommended by a trusted supplier of ours in France, we use Wise for international bank transfers and small balances. RedoxVR’s journey began in 2016, with a clear focus on providing VR kits for educational purposes. As time went on, we earned the prestigious position of being the UK manufacturing partner for Google Exhibitions software, propelling us into new markets and ventures.

“From our main office in Blackpool and our established factory in Manchester, our influence now reaches far beyond the North West of England. Operating in Europe, the US, and the Middle East, we’ve established strategic partnerships with resellers to cater to diverse markets and sectors.

“Due to supply chain challenges, we are now further streamlining our operations by embarking on exciting new ventures in different markets. A new office and hub in Gothenburg, Sweden, is in the works, and we’re also exploring the possibility of establishing a presence in Southern Europe.

“Our partnership with Wise has revolutionised the way we manage our finances. With reduced costs and expedited processes, Wise has alleviated the challenges we once faced with other financial institutions, like Santander, where delays often hindered our operations. Wise has undoubtedly played a pivotal role in our success story.”

For more information on Wise, or to set up an account, visit:

https://wise.com/

*Research conducted by Censuswide of 1,500 SMEs based in the North of England and Scotland